1031 Exchange Program

Whether it’s your first 1031 exchange, or you’re a seasoned exchanger, our team will help you identify the ideal up-leg for your upcoming trade.

We have a 100% exchange success rate.

Your 1031 Exchange Partner

The Glaser Group 1031 Exchange Program guides you through the necessary requirements of Internal Revenue Code Section 1031 with the expertise of our team, coupled with access to high-quality Qualified Intermediaries (QIs). Our program is bespoke and customizable, allowing you to achieve your real estate investment goals and ultimately improve your financial position.

IT’S ALL HANDLED - Together we will begin identifying your up-leg investment property from the moment that you list with our team, taking the guesswork out of your 1031 exchange.

INDIVIDUAL STRATEGY - We take time to fully understand your motivations for owning commercial investment properties. We then sit down with you to rank these underlying motivations and create a long-term strategy that will help you achieve your financial goals via a properly executed 1031.

ALIGN TIMELINES TO MAINTAIN CASH-FLOW - We execute several strategies to make your exchange a stress-free process, while also reducing downtime in cash-flow. Firstly, we work to build in Seller extension clauses into your downleg escrow, allowing for more time. Additionally, we often submit offers on your upleg property, or even remove contingencies, prior to the sale of your downleg property has closed.

Multifamily & Residential

Multifamily and other residential investment properties are a tried and true asset class known to be resilient in the face of economic downturn and volatility. Many of our multifamily-focused clientele prefer to keep their holdings within multifamily real estate by rolling their capital into new apartment deals via a 1031 exchange.

Whether seeking larger properties with more units, improved cash flow, newer construction deals, or better locations, our team has a long track record of successfully exchanging from Multifamily to Multifamily.

Triple-Net Properties (NNN)

Triple net lease, triple-net, or NNN, refers to a type of commercial real estate lease where the tenant or lessee pays the full expenses of the property. This includes real estate taxes, building insurance, and maintenance, in addition to the cost of rent and utilities. Many of our clients exchange into safe, long-term triple-net properties to relieve themselves of the day-to-day management of owning and operating investment real estate.

We leverage a vast network of net-lease focused agents around the U.S. to help our clients identify ideal NNN exchange properties.

Delaware Statutory Trusts (DST)

A Delaware Statutory Trust (DST) is a real estate ownership structure where multiple investors can purchase an undivided fractional interest in the holdings of the trust. This allows professional real estate operators, or “DST sponsors”, to identify and acquire institutional quality real estate, and then sell off partial interest in the trust to 1031 exchange buyers. DSTs offer investors the opportunity to invest 100% passively into institutional real estate deals while benefiting from monthly cash flow distributions and depreciation.

Our team works directly with many major DST sponsors and DST brokers around the country.

1031 Exchange Case Studies

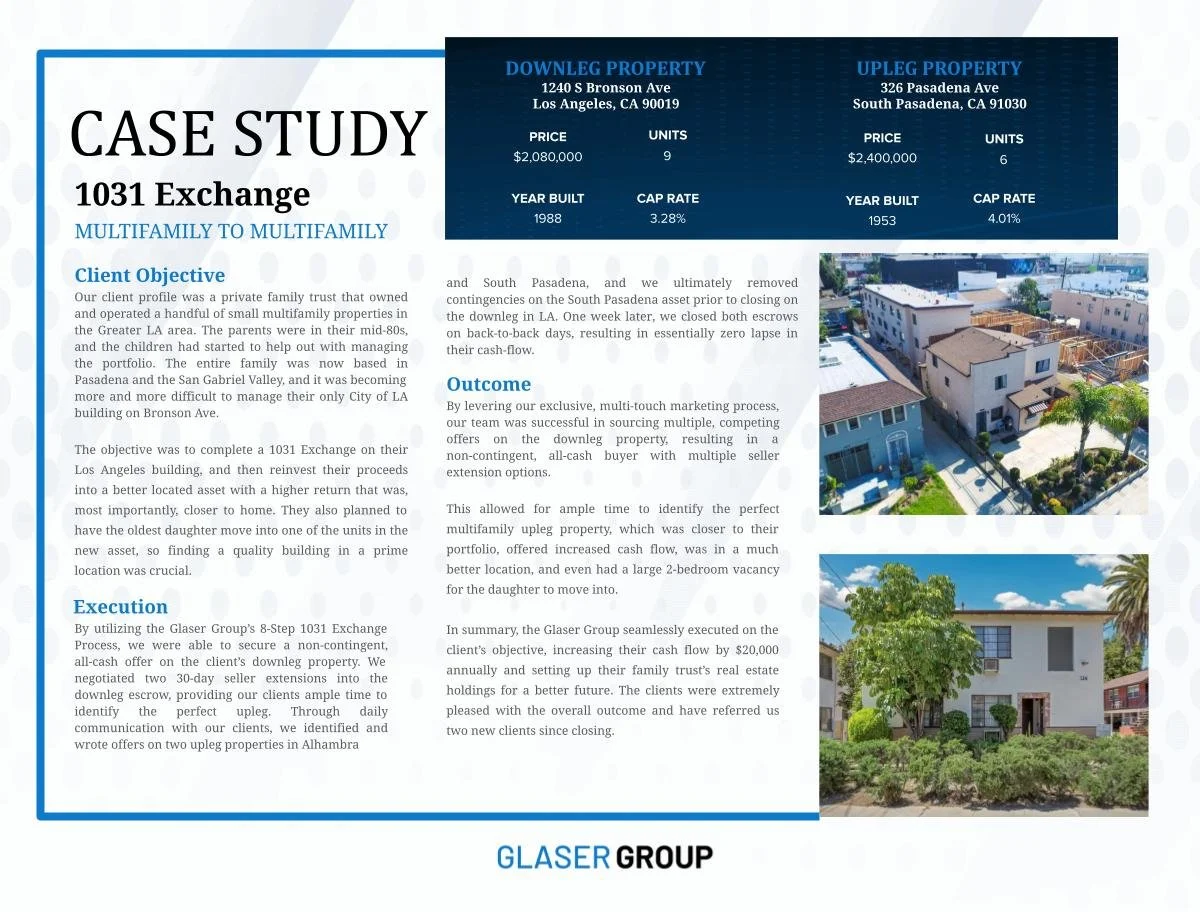

MULTIFAMILY TO MULTIFAMILY

Click here to download the full case study.

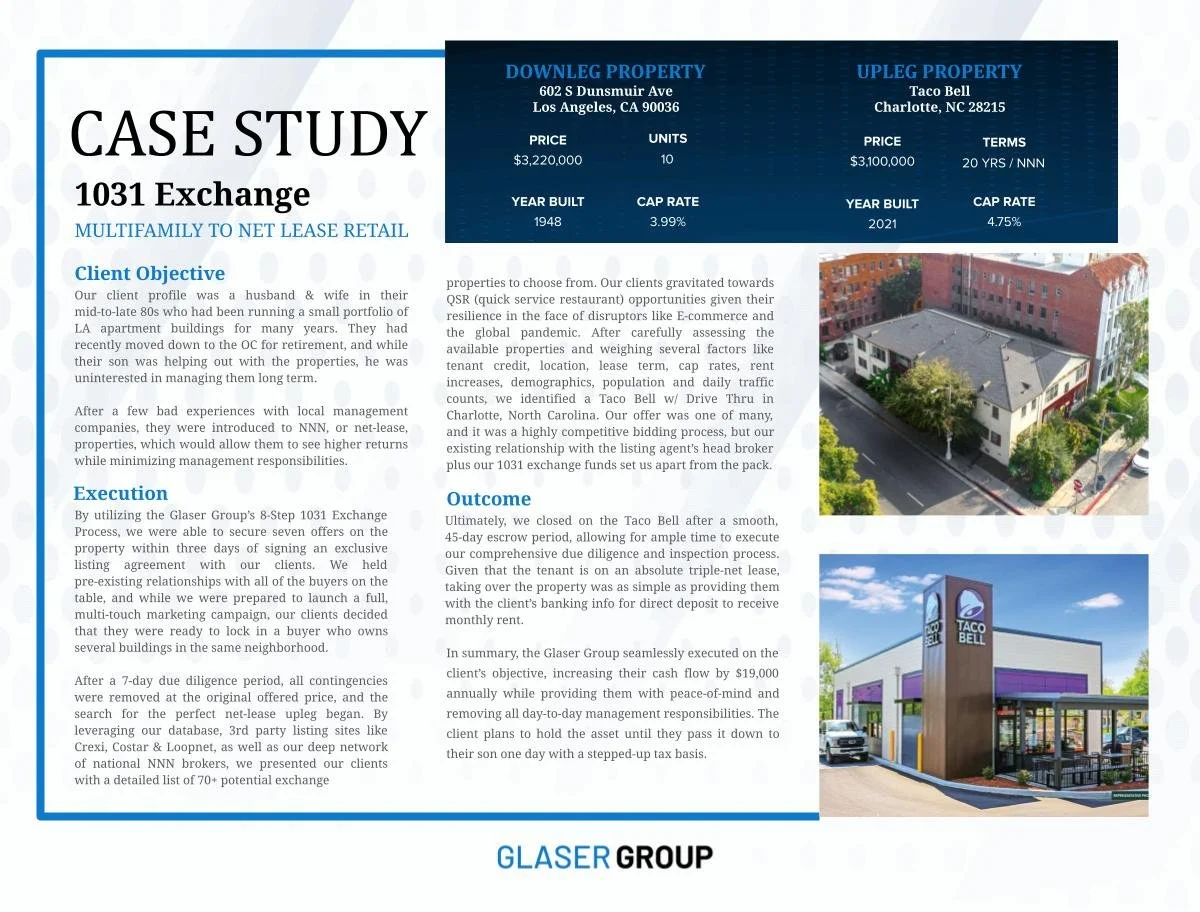

MULTIFAMILY TO NET LEASE

Click here to download the full case study.

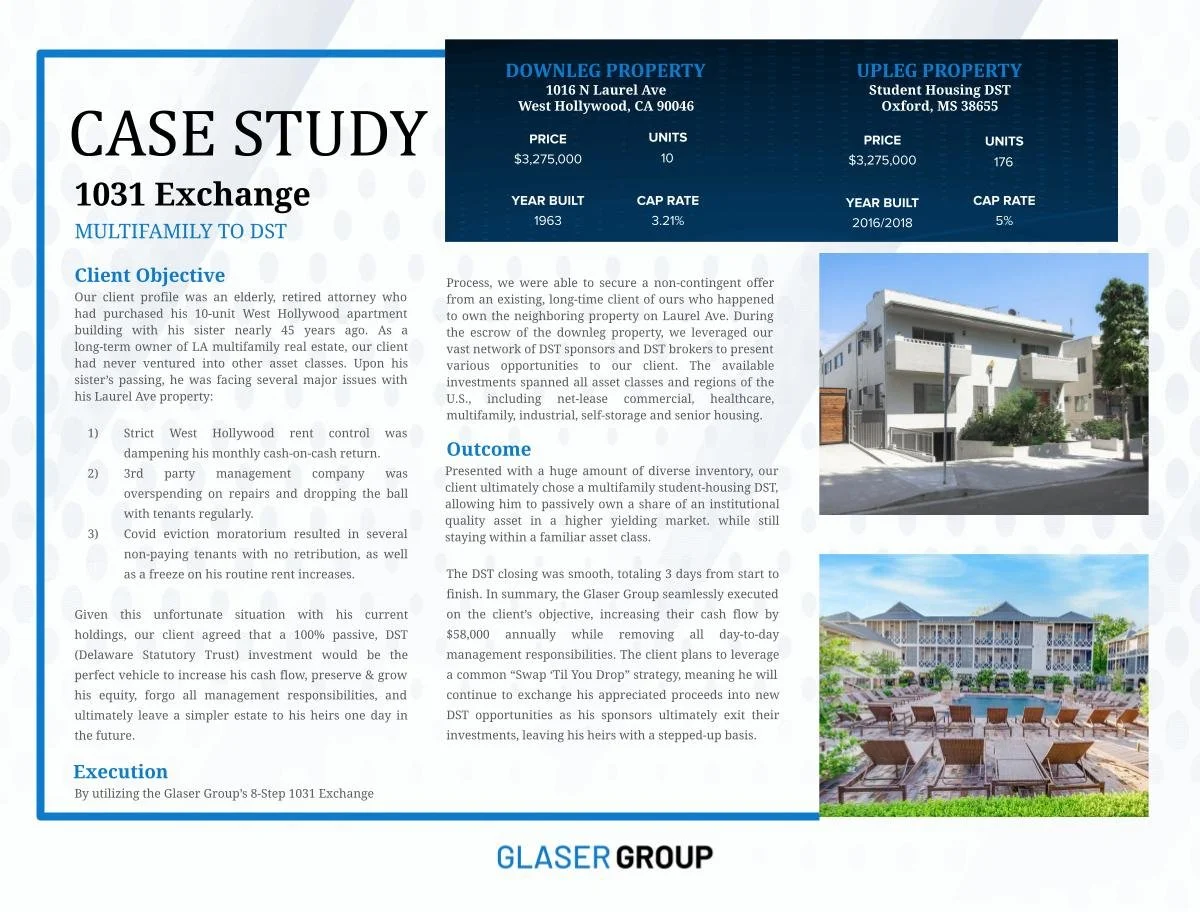

MULTIFAMILY TO DST

Click here to download the full case study.

The Glaser Group 8-Step Exchange Process

1. LISTING SIGNED - Sign exclusive listing agreement with the Glaser Group.

2. MOTIVATIONS - Rank your underlying motivations for owning commercial investment properties.

3. IDEAL UPLEG - Define your ideal upleg exchange property.

4. EXECUTE DOWNLEG SALE - As your trusted advisors, we execute and deliver on the sale strategy for your downleg property.

5. SOURCE PROPERTIES - We source, vet and recommend a large list of available properties.

6. QUALIFIED INTERMEDIARY (QI) - We pair you with a trusted QI / Exchange Accommodator from our partner network.

7. IDENTIFICATION - Identify up to three exchange properties.

8. OFFERS & CLOSE - We submit your LOIs and offers on your target upleg properties. Glaser Group assists in all aspects of due diligence and ultimate closing.